If you end up “old and broke” you can blame the younger you for being broke!

CASH and INFLATION

Many people have been setting on the sidelines through the election of 2020 and the aftermath not sure of which way the market is headed. This is not to mention those that have been sitting on the sidelines since the onslaught of the Covid-19 pandemic and the market bottom of March 2020. From articles I’ve researched there is trillions of dollars just sitting in cash waiting for the right time to invest it. As a financial advisor for 42 years (now retired) I have always hated cash. I’ve also learned that the market is hard to time and “Time in the Market” will generally make more money for you since “Timing the Market” tends to lose so much money. REMEMBER: Cash makes no one but the banker richer. The returns have always lagged the inflation rate and the tax rate and people who hoard cash may not lose cash but they certainly lose purchasing power of the cash.

For example a dollar that I had in 1976 and held all that time at 0% interest (in the piggy bank) based on the amount taken from it by inflation each and every year (measured by the Consumer price index, CPI) is now worth about $0.22. To get this number I simply went to the website bls.gov/data/inlfation_calulator and came up with this calculation:

What this means is that if you were going to buy something in June 1976 for one dollar, that item by November 2020 would cost about $4.58. Said another way $1.00 in 1976 is worth about $0.218 today.

Just to keep pace with inflation (using a financial calculator) an investment in cash would have to earn a net rate of return (after taxes and inflation of 3.519% every year over the 44 year period for it to grow from $1.00 to $4.58. While I could not find a chart going back 44 years on bank savings rates … I did find one going back to 2004 as you can see below. The red line marks the amount you would have to get each and every year to beat tax and inflation from taking a hunk out of your nest egg. As you can see it is not looking very good:

Let’s also remember that if Inflation is at say 3% and your tax rate is no more than 15% … A combined 18% to net a 3.52% after tax, after inflation return your actual return would have to be 4.293%. Bank accounts are simply not going to get you there these days. You will hear talk of 15% CD’s back in the early 1980s. Yes I lived through these days. However back then we also had inflation rates of 15% and higher during some periods – and taxes are constant … they never stop.

The Banker is Making Money on Your Money

After doing much research on Bankrate.com I’ve found that banks are willing to pay as much as 0.50% per year today on savings accounts. At the same time they are loaning your money out at a rate of 10.3% to 32% per year in personal loans based on the borrowers credit rating from Excellent to Bad. So, assuming the excellent rating your bank is lending your money for personal loans at a minimum of 10.3%. This means if they are paying you 0.50% and charging someone else 10% to borrow your money (it is yours and not theirs) they are in effect charging you 9.5% per year to have your money on deposit. Sure, Mortgage rates are lower … but even at a rate of 3.50% for a 30-year fixed rate mortgage the bank is still holding your money for a profit to them of 3% per year. How is this making you any money and how will this help you increase your net worth?

If you think the Bank does not charge you to invest there … think again. Also remember all the other charges they put on you for their service. It is unbelievable the amount of money bankers can make on unknowledgeable people – but there is not many other choices for small emergency funds. However, you should not keep the bulk of your net worth at the bank in a bank account. I will no go into detail here but many of my clients in past years were amazed at the amount of money they could make by taking there large savings accounts and simply buying bonds or preferred stocks (two pretty safe investments) from the same bank that was paying next to nothing for their savings accounts.

Another Option To Consider

Another option to consider is just that … an Option. Specifically a Put Option.

What is a PUT Option?

A person will buy a put option if they think a stock is going to go down in price. Let’s say XYZ stock is currently selling for $40 per share and the investor is thinking the price of the stock will begin a trend down. He/She may buy a PUT option with a strike price of say $40 per share or lower. It will cost them some money to buy this option. For purposes of this example let’s assume they spend $2.00 per share to purchase this option. Remember, options contracts are sold in blocks of 100 shares, e.g. 1 contract = 100 shares. So in this example our investor pays $200 to have the right to SELL the stock at any price below $40 per share for $40 per share. The seller of the option has the OBLIGATION to buy the stock at $40 per share if that is the strike price chosen on the option contract.

As the stock falls in price … the value of the premium paid ($2.00 in this example) would begin to increase in value. Let’s assume the price of the stock drops to $30 per share; the buyer of the option has three choices …

- Do nothing,

- Sell his stock to the seller of the option for $40 per share when the price is now at $30 per share (or if he does not own the stock he could buy the stock for $30 per share and turn around and sell it for $40 per share to the person who sold him the option contract), OR

- Sell the option contract to someone else for the current price which could likely be $4 per share or higher depending on the time remaining until expiration and how fast the stock is falling in price.

But to generate cash on cash we are not talking about buying an option and having rights but rather on selling the option and having obligations and being paid for those obligations.

Let’s look at it from the sellers side, using a real example. In this example I will be rounding the numbers to make the read easier … other than that it is all factual as of this writing.

Selling Put Options to Generate Cash Flow

Information you will need to know:

- Company – Tesla Motors (TSLA)

- Price at time of Option Sold = Approximately $877 per share

- Strike Price of Option = $700

- Expiration of Option – February 19, 2021 (43 days out)

- Price of Option (money received per share = $28.00

- Money setting on the sidelines in the brokerage account = $140,000

- Number of Contracts Sold = 2

Take a look at this one month chart below (showing end of day values). The blue line is the closing price of the stock for each day over the past month (approximately a month). The white, yellow, green and red lines are the 10, 20, 50 and 200 day simple moving averages (in that order). The orange arrow shows the first line of support at $695 per share. This is how I chose a strike price of $700.

The buyer of the option will be what is known as “In the Money” if the price drops below the $700 strike price and the seller (Me) will be “Out of the Money” and will be risking having the stock “Put to me” (hence the name PUT Option) if the price goes below $700. This means I will have to by the stock for $700 per share regardless of how much lower it is below $700. This being the case I will have to maintain a cash balance in my brokerage account of $140,000 (that’s $700 per share for the two contracts – 200 shares – I am obligated to buy).

It should be noted that this stock has a second line of support at the $645 mark as shown in the 3-month chart below:

When I am looking for stock that I would consider selling PUT options on … I am looking for stock that has a strong trend up with the 10 day Simple Moving Average (SMA) being above the 20 day SMA, and the 20 day SMA being above the 50 day SMA and finally the 50 day SMA being above the 200 SMA with the 200 day SMA trending up.

Now I know what you are thinking … “But Jerry, the stock is at an all time high. Aren’t you afraid the trend will start back down?”

Well it certainly could — but it would have to drop about 20% in price before I had the stock put to me — and it would have to drop to that in the next 43 days (always go short term e.g. 45 days or less when selling options).

Let’s take a look at some previous all time highs with this table below:

If I made this move on 12/18/2020 people would still be saying, “But Jerry, the stock is at an all time high. Aren’t you afraid the trend will start back down?” Well, how do you feel knowing that since that day the stock has moved up to another all time high of $877 while hitting four other all times highs since 12/18/2020?

So, with the highs moving up recently every few days … what’s to say they are not likely to continue. Have you never heard the term “Make the trend your friend?”

Remember the price of the option from above?

What happened when I sold these two contracts is that $5,600 came into my account immediately. True I had to have $140,000 collateralized. However, had I had this money in the bank at 0.5% it would take a complete year for me to earn $70.00 in interest ($140,000 x .05% = $70) and here I’ve earned $5,600 (80 times more) with the click of a mouse button on my computer. If it was in the bank the banker would also loan it out and make between $4,900 and $19,000 in loans while paying me $70.00 (and I’ve actually heard people tell me for 42 years that it cost them nothing to put money in the bank). The brokerage company can’t really loan out my money since it is needed for the next 43 days in my account as collateral in case I have to purchase the stock.

If I do have to purchase the stock it will cost me $700 Per Share or $140,000 for 200 shares. However, since I have been paid $5,600 my true net cost to buy the stock would be $134,400 or $672 per share. I could turn around and sell the stock immediately for $140,000 (assuming a price of $700 per share) — Or I could sell two CALL Contracts against the stock I now own (I’d never recommend selling call options if you did not have the stock to back you up). By selling more call options I would generate more cash on the asset valued at $140,000 or less (depending on the stock price).

I would likely sell the options at the strike price of $700 per share if I were to be assigned the stock today at $700 per share. This way it would be more likely to be called away and I could start all over again by selling PUTS on the stock. How much I would get by selling the calls is hard to tell since none of it has occurred today. I looked at an option chain (shown below) at it appears that a $700 strike call option today would bring in about $205 per share or $41,000!

Don’t be fooled … it is only that high because the stock is at $877 per share so this is about $177 in the money. A better hypothetical example would be to look at an option chain closer to where the stock is today (See Below):

If the stock is at $877 and we sold the $880 Call we would make about $100.45 per share or $20,090. That two is to high since the price is way above the $700 we would have purchased the stock at. However, if you look at the Option Chart Below for the TSLA $700 Call option that would have been purchased on 12/31/2020 when the TSLA stock closed at $705 per share you can see what would have occurred.

That Option premium on 12/31/2020 opened at $68 per share, traded as high as $83 per share and as low as $65 per share and closed that day at $75 per share. So … if we were to get the stock PUT to us and could turn around and sell “At The Money Calls” we could expect another $15,000 ($75 X 100 X 2) being put back into our account — now giving us $15,600 on the same $140,000 value. Selling At the Money Call Options should get the stock called away soon so that we could start the process all over again.

Think of it … if you could generate between $5,000 and $6,000 per month doing this on one stock that would require you to have $140,000 or so locked up … that would be annual cash flow of between $60,000 and $72,000 per year for doing nothing but clicking your mouse a couple times each month. Potential Cash on Cash return would be $60,000 divided by $140,000 = 42.85% to $72,000 divided by $140,000 = 51.43%. Returns like this would allow you to double your money every 1.4 to 1.6 years.

Steps to Take

If you have money you are afraid to put into stock today (especially if the stock has been trending up over the past 1, 2 or 3 months (Microsoft – MSFT) would be another good example … then consider this.

- Step 1: Determine the stock you want to buy.

- Step 2: Determine how many shares you want to buy.

- Step 3: View the chart to be sure of the stock trend.

- Step 4: Look at a PUT Options chain with expiration dates from 1 to 45 days out.

- Step 5: Discount the current stock price by 10% to 20% and see what kind of premium you can get for that put option (I generally look for $1.00 or more per share).

- Step 5: When you are ready, SELL TO OPEN (Pull the trigger), on the number of contracts that will get you the number of shares you want in your account.

Let me walk you though an example using a hypothetical amount of capital in an account. Let’s call it $100,000 and let’s say I really want to own Microsoft that is currently at about $220 per share. By dividing $100,000 by $220 this tells you that you could actually purchase about 454 shares of the stock (fractional shares cannot be purchased). Knowing this you could sell 4 contracts (4 x 100 = 400 shares).

However, remember we are trying to get MSFT at a discount to current value. If we lower the price by 10% from $220 to $198 the $100,000 would allow for 505 shares. This means you could actually do 5 contracts of the option you select.

Next look at the MSFT chart to be sure. Here’s a three month chart:

The price has been up and down between an average of about $210 to $230 per share over the past few months with a low hitting about $199 per share back in October. That is just about a 10% decline that we were talking about above. However, the 10 day SMA is above the 20 day SMA; the 20 day SMA is above the 50 day SMA; the 50 day SMA is above the 200 day SMA, and the 200 day SMA is trending up. So this does pass our chart test.

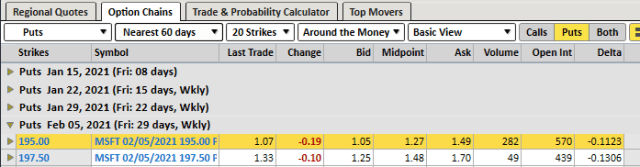

Now let’s look for options. As the graphic below shows we have about 6 expirations to choose from between the date of this article and 45 days out. I will show you some Short-term (15 days); Long-term (43 days) and Mid-term (29 days) premiums and discuss each one.

January 15, 2021 Puts (8 days out):

If we sold the Jan. 15, 2021 Put we would net an income of between 15 cents and 18 cents per share. Let’s say the minimum which is most likely … for 5 contracts that would only be $75 for keeping money locked up for just 8 days … then we could do it again in 8 days if the price of the stock does not drop by 11.4% which it would have to do to have the stock put to us. But again, the premium is no where near $1.00 per share.

February 19, 2021 Puts (43 days out):

You can see here that if we used this option we would generate between $1.71 and $1.82 per share into our brokerage account. In this case that would be about $855 for holding our money in limbo for a period of 43 days. Once this is done we can do it again if the stock did not fall by 11.4% and get put to us.

February 5, 2021 Puts (29 days out):

This option contract would bring in between $1.05 and $1.49 per share. Again going with the lower number assuming the trade was placed “At Market” (and you could always place a limit order to try to get a better price) this would bring about $525 into the account.

So which is really best? That depends on how active you want to be.

- The shorter term trade would allow you to bring about $75 into the account every 8 days … Long term that would be good. That means in 43 days you would have brought in about $375 if you did this 5 times.

- The mid term trade on the other hand would allow you to do this about 1.4 times in a period of 43 days and you would bring in about $735 in that period of time.

- The longer term trade would allow you to bring in $855 for making the trade one time in the 43 day period.

So in this case the longer-term trade would do the best in terms of Dollars for Work Required – but that is not always the case.

Why Keep It Short-term

There are two basic reasons you want to keep your options expiration dates short-term (e.g. 45 days or less):

- You will be able to make more trades per year generating more opportunities for income. As the underlying stock trends up over time so does the new options premiums allowing you to not only generate revenue but to raise the value of that revenue as time passes. However, remember the options premiums that you raised by selling the options initially will go down as the stock goes up.

- Options (see the graphic below) generally give up the last 50% of their value in the last 45 days of their contract time. As a “Seller of the option” you want time to decrease the value quickly. Remember you have already been paid the premium and it cannot be taken back from you even though the option can expire worthless in the end. Gamblers in the Casino (the options buyers) cannot ask the Casino (the option sellers) to refund their money as they walk out the door broke.

Can we roll our options quicker that the expiration date?

Yes I do, and I will close with this. In 100% of the options I sell (also referred to as “write” an option) I will set a profit locker. Here’s what I mean in real terms:

In this you will see that my average cost per share in these two contracts were $28.14. What I’ve told the computer is my brokerage account is to close these contracts out if and when the price drops to as low as 90% of the cost (which in this case is a value of $2.81).

You don’t have to use 90% as an exit. I’ve done well in the past using just 80%. In that case the option would close when the price hit $5.63 per share.

So what does this do for me (understanding that at this point there really is no “COST” to me as I received the $28.14 per share)? First of all as the stock trends up this option price will trend down. Second, because of this chances are good the option will sell out before expiration (say in 25 to 30 days). Third, this will allow me to “write/sell” new options before the 43 day period has past … meaning more money each year.

But most importantly this is what it does. If I received $28.14 to sell the option and have to buy it back for $2.81 (which is what I would have to do to close it out) I will net a return of $25.33 per share.

What is that return?

Simple math: $25.33 divided by $2.81 times 100 = 901.423%

If I take $2.81 out of my left pocket and put $28.14 into my right pocket … my gain is $25.33 or 901.423%. In this case though I am putting $28.14 into my right pocket and taking $2.81 out of my left pocket a few days later and keeping $25.33 –> the return is the same!

Now I don’t let the money I receive for selling these options sit idle (in this case $5,628) I also put that money to work for me. I will tell you how in a new story though.

The point is … when you get old like me the only money you can really depend on being there for you (you cannot depend on the banker or the Social Security Administration) is the money the younger you set aside for the older you. You are going to get older … but there is no reason to get old and be broke at the same time.

Have a great day and make 2021 a Prosperous year!

excellent article. I would love to send this to a few people who are sitting on cash. May I have your permission?

Sure Jim, not a problem. Perhaps it can help you or them.

Thanks, I want to get them off their ass and out of cash. I keep telling them they are losing money and must not believe me and maybe they will believe you.

Spot on. I want the cash working for me and that was particularly important with respect to my inherited IRA account during the voluntary RMD suspension last year. I will tell you that without regret, I sold both my AMZN and BRKB stock at very nice profits last year and never looked back. Neither offered a dividend and despite both having the ability to do so. (See AMZN charitable donations). I could not sustain them in an RMD account scenario.

Curtis Bridges thanks for the comments. I too don’t like the stocks that sent pay dividends that much … which is why I sell puts to buy them and sell calls once I have them. That forces an income outnof a non dividend paying stock.