A special note to my readers: This article took about 3-days to put together and post. It is rather lengthy and discusses and issue that can be deemed complicated. Before taking any action I strongly suggest you discuss it with a competent financial advisor who follows the market and your investments closely.

As an individual, would you purchase a car for $50,000 and not insure it? I can tell you if you financed the car you would insure it due to the lender requiring it. But if you happened to use your own money to purchase the car – would you insure your car against loss? I am not considering the fact that you must carry minimal liability insurance as required by law (which insures the other guy and not you) … would you insure against loss of your car means that you are insuring that if the car is stolen or destroyed in an accident it will be insured, even if the other driver had no insurance.

The answer is; as a logical thinking individual you would insure this vehicle for its full value. Why? Because you cannot stand the thought of driving it down the road and having it destroyed by some driver who is not paying attention. I mean after-all isn’t it always the other guys fault? And what if that “other guy” is breaking the law and does not have liability insurance – or at best only carries the minimum required by most states which is $10,000. This amount of money would not go very far in replacing your $50,000 automobile.

Would you invest $300,000 into a new home without having homeowner’s insurance? Again, if you have a mortgage you would be required to have insurance by the lender. But let’s assume it is paid for. Would you have insurance to replace it if it burns to the ground or is ripped off the foundation by a tornado or hurricane? Chances, again, are very good that you would if you were a logical thinking human being. As a matter of fact, few could sleep at night having one of their largest, if not their largest assets, insured against loss.

Stocks go Up and Stocks go Down

You’ve heard me say time and again that as a general rule the stock market is trending up 70% of the time … and that is true. When I got into the investment business in 1976 the Dow Jones Industrial Average (DJIA) was at 970.97 and today as of this writing it is at 23,703.59 – up 22,732.62 points and it could not be that way if it was not rising most of the time. That’s an overall increase over the last 42 years of about 2,341.22%

The S&P 500 was at 100.92 and today as of this writing it is at 2,557.05 – up 2,456.13 and again, it could not do this if it was not rising most of the time. That’s an overall increase over the past 42 years of about 2,433.74%.

But there are times when things simply do not go that well. For example … in recent months the market has pulled back from a recent high (looking at the S&P 500 since it gives us a broader look at the market) of 2,930.75 on September 20, 2018 to its current value of 2,557.05 today on December 17, 2018. That is a decline of 373.70 points or 12.80%.

If your $50,000 stock was following the market this means you are down from $50,000 in value to about $43,600 in value.

The chart below is in candle stick format and it represents the S&P 500 over the past 6 months of this year. I put the orange lines in so that your can see without doubt that the Highs are getting lower and the Lows are also getting lower:

This tells us that we are in a down market period and it could be short-term (weeks) or a longer term (months) before we see an upturn.

So, again, how many of you had some kind of insurance to assure that you would not suffer losses over the past several weeks in the crazy market.

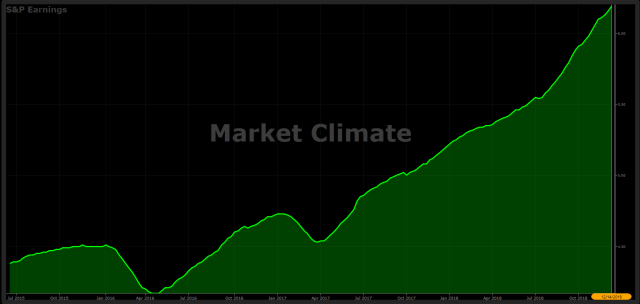

Let me say, before getting into how to insure a stock, that I don’t believe there is any rational reason that the stock market should be declining. Stocks generally follow corporate earnings. If earnings of a corporation are going up the stocks should in turn be going up. The following graphic provided by Vectorvest shows the 50 day moving average of corporate earnings over the past 3 ½ years.

With rising earnings, you generally get rising prices and with falling earnings you generally get falling prices. Think of it logically: If you were going to buy a business would you pay more for one that was earning more money every year or one that was earning less money every year (all other things like nature of business, beginning date of business, etc.) being equal? I think most people would be willing to pay more.

Here’s a couple of examples of that. Look at Merck & Co. over the past one year …

Notice as the earnings per share increases (blue) so does the price of the stock (green). Also notice in the earlier part of the graph when earnings were falling so was the price of the stock.

However, you sometimes will see this (AT&T over 3 months):

Here we see rising earnings while the price is dropping.

What causes “stuff” like this to happen? And can we do anything about it?

The cause can come from multiple things driven mainly by emotion and not fact. It could be bad news, talk of trade wars, talk of rising interest rates or inflation … a number of FEARS that can cause the price of stock to go down even though earnings are getting higher and higher.

Can you do anything about it … not really. The market is going to give us what the market gives us and how you react to that tells if you are going to be a successful or non-successful investor. Take a look at this one-month chart on Johnson & Johnson (JNJ):

It was moving along quite nicely considering an overall down market (earnings still trending higher) then all of a sudden it got plastered yesterday and today. What happened? According to MarketWatch.com:

Unfortunately, this is all it takes to bring a stock back down. If people would read the rest of the article, they would find that that there has been suits against this company by over 11,600 plaintiffs who claim the talc gave them cancer going a long way back. Johnson & Johnson claims that the report was “one-sided, false and inflammatory” and that it ignored thousands of tests by regulators who found its talc to be asbestos-free. One Vice President of Johnson & Johnson even goes as far as to say, “Plaintiffs’ attorneys out for personal gain are distorting historical documents and intentionally creating confusion in the courtroom and in the media.”

Further investigation shows that this battle has been going on since 1972. Yet, people are now allowing it to drive them out of the stock which is causing such a drastic decline. The facts can be found in the financials of JNJ company.

- Their revenue in 2017 was more than $76.4 Billion

- Their cost of revenue in 2017 was a little more than $24.7 Billion

- Gross profit was about $51.6 Billion

- As of 12/31/2017 they were sitting on $17.8 Billion of cash and cash equivalents.

Am I recommending that you go out and buy shares of JNJ today? No! I’m simply educating you on why some company stocks drop even though the company appears to have strong financials and earnings and other fundamentals that are positive. It seems that enough people are concerned about this companies pending lawsuits that they chose to get out of the stock recently, which causes high supply and low demand for the stock pressuring it to go down.

Let’s look at another company that has suffered tremendous lawsuits over the past several years. Here’s a tobacco Company – Altria Group (MO) that has likely paid out millions if not billions in lawsuits since 2000.

As you can see … despite the suits, the trend (long-term) has been up.

You are not going to fight the media and what they put out about a particular company (much of it FAKE NEWS) … but you can defend yourself about losing money in the stock market if you think logically and take precautionary measures. While everyone who buys a stock does so in hopes that it will increase in price (nobody buys hoping it will decrease in price … if they are logical and sane) – we should all make “CAPITAL PRESERVATION” our #1 priority.

How do you do that? With insurance!

Ways to Reduce Losses

There are several ways to reduce your loss or potential loss when you invest in stocks or exchange traded funds (ETFs).

- You could use a stop loss order,

- You could use a stop limit loss order,

- You could use a Trailing Stop Loss, or

- You could purchase a contra ETF (a subject for another article), or

- You could buy a put option (an insurance contract) on the stock.

What is a stop loss order?

Let’s say you purchase 1,000 shares of XYZ at $50 per share … and investment of $50,000. You should determine an exit strategy BEFORE you purchase the stock. Remember, you have to have a plan and stick with it. One of the worst plans in the world is to buy a stock thinking you will never sell it. Why on earth would you want to hold onto a stock that is consistently losing you money?

Yea I know what the Oracle from Omaha (Warren Buffett) states … buy a company like you never want to sell it. And while that may be true for billionaires … it is not true for the everyday Joe or Sally. Had you bought WorldCom (WCOM) in 1996 after the Wall Street Journal told everyone that WorldCom had provided Steller returns to investors over the past 10 years of 57.3% per year … with no anticipation of ever selling it … your stock would have gone to zero by July 2002 just 8 years later.

A stop loss order is an order to sell a stock when its price hits a certain dollar amount. For example, if you invested $50 in the stock on a per share basis and was willing to accept a 10% decline in value you could enter an order right after buying the stock to sell it if the price hit $45. These orders can be placed for a day period or Good till Cancelled (GTC) which at most brokerage firms is from 60 days to 6 months in duration (check with your broker). This is how this works …

You pay $50 for the stock. If it goes up nothing happens. If it goes down to a price of $45 or less your stop loss order is triggered and your stock sells at the next market price. Therefore, $45 is not a guaranteed price the stock will sell it … it is only a trigger to let the market maker know that the next market price should be yours and this can be higher or lower than the $45 trigger price.

ADVANTAGE

- Stock or ETF will be sold at a price just above or below your trigger price so you will reduce losses.

DISADVANTAGES

- In a volatile market scenario, the stock could hit the trigger price, get sold, then bounce right back up to the previous purchase price.

- If you buy the stock back within 30-days you could fall under “wash-sale” rules which would not let you take a tax deduction for any losses you incurred (would not matter if a tax qualified plan such as an IRA).

- As your stock trends up you may have to manually update your stop loss order if you want to maintain the 10% market drop from current value rather than from original cost. This take time and time is money for everyone.

What is a stop loss limit order?

This is much like a stop loss order with one exception. Here you are telling the market maker to sell the stock at a certain price with a “Limit” on the amount you are willing to accept.

For example; you might buy the stock at $50 and enter a “stop loss limit order” of $45 per share. This in essence tells the market maker that you are willing to accept a 10% loss but will not accept less than $45 per share.

ADVANTAGES

- In this case your trigger price would be your sales price. But view the disadvantages.

DISADVANTAGES

- If the market for the stock goes below $45 it will never sell if it does not rebound. If it does rebound, would you really want to sell the stock?

- You could be stuck holding the stock all the way to the bottom unless you changed your order to a new stop loss order or even a market order.

What is a trailing stop loss order?

This one is especially interesting. It can be entered as a trailing dollar amount or a trailing percentage amount. This trailing order follows the stock up but never down.

Assume you buy the stock for $50 and enter a trailing stop loss order at 10%. What this means is that your initial “trigger price” with the stock at $50 would be $45. If the stock moves up to $60 per share your trailing stop would move up to $54 per share ($4.00 more than what you paid). If the stock continues to move up to $70 per share your trailing stop trigger price will move up to $63 per share (or $13 more than you paid). If the stock drops back from $70 per share to $65 per share your trigger price of $63 per share would remain frozen. If the stock continued to move down below $63 per share the trigger price would be hit at $63 and the next market price would be what you stock sells at.

This chart will give you and idea of how this can work over time:

As you can see when the stock price drops the stop price does not.

Now what happens if the Stock Price on the last period shown did not go to $80 per share but rather fell to $69 per share due to “bad news?”

You would likely get somewhere in the neighborhood of $71 per share which is still $21 more than you paid for the stock or ETF. That would net a return of 42% over this period which could be in days, weeks, months or years.

ADVANTAGES:

- You have a stop loss in place that will follow the stock up but not down.

- It is possible to get out of the stock if it has trended up for some time with a gain rather than a loss.

DISADVANTAGES:

- You may be getting out of a stock on “Fake News” that is really not all that bad and it could start heading back up in the near future.

- If you buy the stock back within 30-days you could fall under “wash-sale” rules which would not let you take a tax deduction for any losses you incurred (would not matter if a tax qualified plan such as an IRA).

- You will have to reset your stop loss from time to time as the orders expire.

Now people wonder why the market is so volatile? This could be one reason. More and more people are using stop losses to take them out when markets become volatile. The further the market declines the more it wants to decline because of electronic trades such as these. That’s not all bad if you are saving yourself from taking losses … but it does come with the caveat that the lower the market goes the lower it can go due to stop loss orders taking people out of the market.

I normally will not recommend a stop loss of 10% or less. I normally consider stop loss orders of 15, 20 or 25% to be better simply because you stop some of the erratic trades in the market. Remember the market is not going into a bear market scenario until it has dropped 20% or more from its previous recent high. The same can be said for an individual stock or ETF. You see a problem with stop losses is that you must be willing to accept a loss. You cannot set a stop loss at the price you purchase a stock or ETF at. If you pay $50 per share and attempt to set the stop loss at $50 … chances are good the brokerage firm will not allow it and if they do … the first tick below $50 would take you out of the stock for a guaranteed loss at the outset. It is important to remember here that an unrealized loss is just that … a paper loss. A realized loss or real loss occurs only when you actually do sell something for a lower price than you bought it at.

So, how is a Put Option an insurance contract?

If you recall from previous articles and option is a contract between a buyer and a seller. If a person believes a stock is going up in value, they may buy a Call Option. If they believe it is going down in value then they would buy a Put Option. In order for them to purchase an option there must be someone who is willing to sell them the option. This graphic summarizes the difference between Puts and Calls and Buyers (Holders) and Sellers (Writers):

Pay particular attention to block #3 (Put Buyer). Also Block #4 (Put Seller). The buyer has a right to sell the stock at the strike price of the put option contract. The seller has an obligation to purchase the stock at the strike price of the contract.

Again, think of auto insurance. If you are insured and have a “fender bender” you have a right to file a claim against the insurance company and the insurance company has an obligation to repair the vehicle at their cost, less any deductible you may have. If you were to back into a light pole and do nothing more than break a tail light, chances are you would not file a claim. This is like having a Put Contract at a strike price of $50 on a $50 stock and the stock temporarily to $49 or $48. You may choose to hold the stock and not file a claim against the seller of the put (your insurance company). But if you do file that claim the seller has an obligation to pay you for it. Now if you were to get in a major accident with say a tree (in other words your fault) you will likely file a claim against the insurance company and get the automobile repaired or replaced depending on how much damage.

Well buying a Put Option on a stock you hold is the same thing as insurance. If you pay $50 for the stock you can buy a put option (at the money of $50) and if that stock ever goes below your purchase price you can force the seller of the put to buy your stock at $50. This is known as putting the stock to the seller … hence a Put Option. But again, you have the right … not the obligation … to do this.

Let’s face the fact that if you buy a stock you buy it because you believe that it is going to go up in value. People just don’t invest money in an asset believing it will go down in value. Now you may buy something of value knowing that it will go down in value (like a car) but you would not invest thinking the price is going to decline. But you know the old saying (and I will keep it clean) “Stuff” happens – and you know what “Stuff” is. If you don’t insure that $50 per share investment … then you are at the mercy of “Stuff.” If you do insure it … then you are taking precautions to mitigate your risk – which is the smart way to invest. Mitigating risk is also the reason we put a diaper on a baby … “Stuff” happens that is beyond our control – that is simply a smart way to parent. 😊

We have to remember, with any insurance policy there is a premium. This is the way insurance companies make profits … charging premiums in hopes that their premiums exceed claims … and they usually do on a broad scale. Insurance companies will charge you monthly, quarterly, semi-annually or annually. But they may also charge just for a term or an event.

Did you ever play in a golf tournament and see that beautiful Cadillac the sponsors of the tournament were giving away for a hole-in-one on a par 3 hole. Do you think if someone wins the Cadillac that the sponsors have to come out of pocket for the $75,000 to $100,000 that the car may cost? They don’t. They purchase an event insurance policy. They probably pay $1,000 or so in premiums and if someone is lucky enough to get a hole-in-one (and believe me after two in my short golf career it is all luck) the insurance company is “obligated” to foot the bill for the car. If no one wins it … the insurance company is off the hook after the tournament and gets to keep the $1,000 premium.

Automobile insurance, home owner’s insurance and health insurance are all the same. If you pay the premiums and never have a claim you can’t ask the insurance company to give you your money back. They earned it and can keep it because they were “obligated” to pay a claim if you ever produced one. There are people in the investment community that make a living selling Put Options. Some people sell them because they want the stock to drop to a particular price before they invest in it. Others sell them because they want to generate income on stock that they believe will go up in value and they will never be forced to purchase the stock. This creates a stream of income for them.

As a career financial advisor, I once had a retired oil man as a client that made over $90,000 per year simply selling Put Options to investors who wanted to insure their portfolio or speculate on the price of a stock dropping. That $90,000 per year was double his pension income and about 4 times his social security income.

I previously wrote an article Getting Paid To Wait that you can read here. If you have not read it, I suggest you do after reading this one.

Getting back to insuring your investment with put options this is how it would work:

Marry a Put Option:

Let’s assume today that you want to purchase XYZ stock at $50 per share. You are almost certain the stock is going to trend up, but being a smart investor, you decide to “Marry Your Stock to A Put Option” at the same $50 strike price just in case it should trend down.

If you were to buy a $50 put on this stock with an expiration date of January 18, 2019 (the 3rd Friday of January) it would cost you about $1.25 (depending on the volatility of the stock). So, for one month you would pay a premium of $1.25 per share (or on a 100 share purchase a premium of $125 not including any commissions). In effect you are saying if the stock drops below $50 over the next 30 days you have the right (not the obligation) to sell it to the Put Seller (writer of the insurance policy) for $50 per share regardless of the price of the stock when you exercise your option.

What this means is … should the stock drop to say $40 per share between now and January 18, 2019 you could force the Put Seller to pay you $50 per share. The seller would be obligated to pay you $50 per share … this is why you paid him/her/them $125.00. Remember on January 18th your option expires and if you want insurance still … you would have to purchase another policy (Put Contract). Depending on the price of the stock at that time … the price or premium could be higher or lower.

If you ended up doing this every month you would have paid $1.25 X 12 X 100 = $1,500 to insure your 100-share investment of $5,000. That’s a little too much if the stock stays at $50 per share. But understand … the stock when purchased … at least in your mind was going to go up in value – so you would likely increase the value of the Put Option each time you placed a trade or reinsured it.

If you are really looking at the long-term, you may instead want to purchase a longer-term option contract. For example, rather than a one-month expiration – do a one-year expiration. The cost of this contract may be $5 per share or $500 which is 1/3rd the cost of a monthly contract each month. Now the most you can lose if the stock drops to zero between now and the maturity or expiration date of the Put Option Contract is the $500 you paid for the insurance.

Keep in mind, like with any insurance contract, you the insured have a right to cancel it at any time. You do this by simply buying it back. For example, let’s say the stock does trend up to $60 per share and the price of the option you purchased decreases to $2.50 per share. You would simply sell the option back and get $250 (assuming 100 shares) for a net loss to you of $250 rather than a loss of $500. Then you may want to buy another Put Contract (insurance policy) that would pay you $60 per share regardless of where the stock trends thereafter.

Generally speaking as a stock price grows in value the option price decreases in value as shown in the chart below:

Here the stock price goes from $52.34 to $60.80 over a period of 4 months while the bid price of the option decreased from $4.60 to $2.01.

However, when volatility is added to the picture even though the stock may decrease in price the options bid price can increase as shown in this graphic below:

In this case the stock drops from $60.08 per share to $51.56 in a period of 4 months and the options bid price (premium) actually increased from $2.35 to $4.90. Think of volatility having influence on insurance premiums (options pricing) like attempting to insure a $300,000 home. All things being equal, except neighborhood, it is less costly to insure a $300,000 home in a great neighborhood than it is to insure one in a terrible crime-ridden neighborhood even though the Federal Government has attempted to enact laws that forbid charging more in bad neighborhoods. Or it is less expensive to insure a home that is inland than it is to insure a home that sets on a coast line of the ocean where hurricanes are yearly events.

Here’s an example of an actual Put Option Chain for a stock on Bristol-Myers Squibb Co. (BMY) for January 18, 2019:

You will see that I have highlighted the $50 contract. The Bid Price is $1.26 but the option is good for only 30 days.

Here’s the same option chain for the January 17, 2020 Put Option:

The Bid Price here is $5.05 but the option is good for 394 days. This will give you some idea as to why I suggest a long-term option rather than a monthly or short-term option when trying to protect a portfolio or stock in a portfolio.

Again, this is known in the investment world as “Marrying your stock to a Put Option” for protection on the downside.

ADVANTAGES:

- You can sleep assured each night that regardless of what happens in the market over the next several days, weeks or months your investment is well protected should the worst occur.

- You can buy a put at very close to the amount of your investment on a per share basis, or if you are willing to accept some of the risk you can lower the strike price and pay less of a premium (this is like increasing the deductible on an automobile insurance policy).

- When the stock actually drops below the strike price you have an option to sell it or hold it … unlike a stop loss order where you will actually be required to sell the stock because it is automatic. This will stop you from possibly losing a good stock due to whip-saw action on minor bad news. It will give you time to think through any actions you decide to take logically. Even as the price continues to trend down you have a guaranteed price at which you can put it to someone without making snap irrational decisions.

- You can increase your policy value as your stock grows in value.

DISADVANTAGES:

- This is not free like setting a stop loss. Like any insurance policy it will cost you the premium.

- The shorter the term of the contract the more you will eventually pay for protection (like paying monthly vs. annual premiums on an automobile policy).

- The higher the strike price of the policy from the beginning the more you will pay in premium (like lowering the deductible of an automobile or home-owner’s policy).

One last thought for Mutual Fund Investors:

What if you only invest in mutual funds and not Stocks or ETFs. How do you protect a portfolio with insurance when you can’t buy put options against a mutual fund (and you certainly can’t use stop loss orders since mutual funds are actually after-market hours investments)?

The answer is you still can, by purchasing put options on a stock index or a stock index portfolio (ETF) to protect your portfolio. Here you have to make sure which index your portfolio of funds is tracking. If it is tracking a large cap portfolio index you might use an index fund for the S&P 500 Index. Or if it is tracking a small cap index you might use an index fund that will track a small cap index such as the Russell 2000 index. Once the determination is made, the rest is pretty easy.

Here’s an example: Let’s say the value of your mutual fund portfolio is $100,000 and you don’t want that price to drop much should we get into a period of uncertainty or volatility and you don’t want to have to sell your mutual funds if the period of uncertainty is simply a short-term reaction to bad news. You know that you cannot put stop loss orders into effect on mutual funds since these are market sensitive orders and mutual funds trade after market hours. In other words, if you put in an order with your broker to sell a mutual fund at 11:00 AM … the fund would not actually get sold until after the market closes because there is no intraday value of the fund. This is also why you can’t buy put options against a regular mutual fund as well.

The first thing to do is know the value of the portfolio that you want to insure. In this case $100,000. It could be made up of one fund or multiple funds. The second thing is to know the value of the underlying ETF that you are going to insure it with. Assuming you are using the S&P 500 index you may choose a fund such as the S&P 500 Trust ETF (SPY).

Next you simply divide the value of your portfolio by the price per share of the SPY ETF and round to the nearest 100, then divide this amount by 100. This will tell you how many Put Contracts you must buy on the SPY ETF. See Below (which assumes at the time of this writing the price of one share of SPY was $258.20):

In this case you would purchase 39 call contracts on SPY since you cannot purchase 38.7 contracts. How much would that cost you in premiums?

See the table below (remembering that 1 contract equates to 100 shares of the underlying investment):

If you purchased 39 Put Option Contracts at a price of $18.50 per contract … you would spend $7,215 to insure your portfolio of $100,000 for a year (that’s $18.50 X 390 shares). If your portfolio were to decrease in value … even all the way to zero … you could force the sellers of these Put Options Contract to pay you $255 per share for 390 shares of SPY or $99,450.00, for a net loss of $550 + the cost of the contract $7,215 = $7,765 or 7.77%. If you did not insure it and the market value dropped by 15% you would be down by $15,000 or double the cost of insuring it.

This would also be a good strategy for a person that had several stocks or ETFs and did not want to insure them one at a time.

So, what would happen if the market (and ultimately your portfolio) did not decrease but rather increased in value before the expiration date of the Put Option Contracts? You could always close out your contracts by selling them on the market and recapture some of your premiums … the same way as if you paid an annual automobile insurance premium or health insurance premium and decided 6 months later to cancel the policy. The insurance company is required to pay you back any portion of the premium it did not earn.

That pretty well wraps up this article on insuring your investments. Here’s some takeaways to consider:

Summary and Takeaways:

- Understand the stock market can go up and down. While it mostly goes up long-term … there are periods that it goes down so drastically that it causes fear in the hearts and minds of even the best investors.

- Make sure to have an entry and exit plan in place before investing your hard-earned cash into equity investments and derivatives like options. Then, by all means, stick to your plan. You plan should always expect the best but anticipate the worst … then capitalize on whatever comes your way.

- Understand that while fundamentals of a company may look good, that is no guarantee the stock will rise or continue rising over the short-term. Insure your stocks and/or portfolio against uncertainties.

- Don’t fall in love with investments. There is absolutely no reason to hold an investment that continues to trend down to nothing (WorldCom stock is a good example) especially if you have not protected it with a viable put option.

- Make the “trend your friend.” Understand that nobody gets into the market at the exact bottom and nobody gets out of the market at the exact top – on purpose.

- Stop Loss orders can offer you protection against losses with no choices, but put options allow for protection with the ability to choose whether to act or not. You can literally save thousands of dollars for a few pennies. Put options may cost initially, but could save you more in the long-run. Marrying a put option to your stock or portfolio of stocks is not a bad way to mitigate losses.

- Remember, if you are reading this article you likely don’t have enough money to really influence the market in one direction or another. However, the FED does. Look at what happened today after the announcement of another interest rate hike of 0.25% raising the Fed Rate to 2.50%.

You can see by this graph the Dow Jones Industrials opened today at 23,693. By 2:00 PM/ET the index had risen 364 points to 24,057. Due to all the bad news still in the marketplace (trade wars, etc.) this increase was mostly in anticipation of the Fed not raising interest rates this quarter. Most economist believed they would not.

However, at 2:00 PM/ET the Fed President spoke and decided to raise interest rates another 0.25% bringing the Fed Rate to 2.50% (which is still extremely low compared to several years ago) and all heck broke loose in the marketplace.

By 3:05 PM/ET the Dow had dropped 895 points to 23,162 and it ultimately closed at 23,325 at 4:00 PM/ET with a drop of 370 points from the open today. And, to top it off, the Fed did mention that it would likely only raise interest rate 2 times in 2019 rather than 4 times … yet the investing public was still squeamish and scared … or was it those darn computers and algorithms that call for stock sales at the slightest whisper of interest rate hikes?

So, are you protected? If not … you may want to look for a PUT to marry your stock/portfolios too.

Have a great rest of the year – perhaps things will stabilize in 2019.

Jerry Nix, your Freewavemaker!

Disclaimer:

This information is not recommendations for you to purchase or sell any investments outlined in this article. The information is being shared for educational purposes only. I recommend that you seek the advice of a licensed and competent financial advisor before taking actions on your portfolio if you see a need to after reading this article.

The author of this article is long on the following investments outlined herein: Merck & Co. (MRK) stock and options; SPDR S&P 500 Index Fund (SPY).