In this article it is my intent to share some money management techniques you can employ to protect your investments from taking severe losses during normal and abnormal market downturns. You’ve often heard that having an investment plan is important. Unfortunately, most believe in an investment plan when it comes to buying a security … but what about an investment plan when it comes to selling a security.

In this article it is my intent to share some money management techniques you can employ to protect your investments from taking severe losses during normal and abnormal market downturns. You’ve often heard that having an investment plan is important. Unfortunately, most believe in an investment plan when it comes to buying a security … but what about an investment plan when it comes to selling a security.

It is easy to buy a security. We all believe that once we buy the security is going to go up in value. The hard thing is selling a security. For some reason, we as human’s tend to “fall in love with what we buy.” Why is this?

The short answer is that if we must sell it because it is losing value we have to “admit we were wrong for buying it” and none of us want to admit we were wrong. Thus, we sit back, lose sleep and keep telling ourselves, “Don’t Worry … it will come back,” all the while losing sleep because we really don’t believe it. This not only causes us frustration, but in many instances can cause those we love the most frustration because we are not happy, and if we are not happy, we can cause those around us to be as miserable as we are.

Today we are going to talk about EXIT STRATEGIES that take the emotion out of when to sell a security. I may not going to cover all the exit strategies you can read about … but I will cover the most important ones … and will also attempt to tell you the risk that are involved in each one. When it comes to “buying” or “selling” securities — there are always risk — and you should never let anyone tell you any different.

There are even risk in “holding” certain securities. For Example: You could be holding one that is appreciating at just 2% per year when you could be holding one that is appreciating at 10% or more per year.

Exit Strategy #1 – Stop Loss

A stop-loss order—also known as a stop order—is a type of computer-activated, advanced trade tool that most brokers allow. The order specifies that an investor wants to execute a trade for a given stock, but only if a specified price level is reached during trading.

Stop-loss orders differ from a conventional market order. With market orders, the investor specifies that they wish to trade a given number of shares of a stock at the current market-clearing price. Using a market order, the investor cannot specify the execution price. However, the stop-loss allows an investor-specified price.

An Example:

Let’s assume that you paid $20 per share for stock and it has risen to a price of $30 per share. You are sitting on a nice 50% return and don’t want to give it all back. There is one rule out there that states you should “never give up more than 50% of your gain.” In other words, if you have a gain of $10.00 (in this case) … the most you should be willing to lose is 50% of this or $5.00. You could enter an order on the stock that simply states if the stock drops to a value of $25 per share you wish to sell it automatically without having to be at the computer or calling your broker to make the trade.

Risk of Stop Loss Order:

A $25 stop loss order does not guarantee that you will get $25 per share on your stock. What it does guarantee is that you have set a “trigger price” that would execute at the next market price should your stock hit $25 per share. Therefore, you could get more or less than $25 per share for the stock. If the stock hits this price during normal market hours and it is a stock with a lot of volume (e.g. trades 100,000 shares or more per day) the chances are good that you will get within pennies of the $25 order you requested.

If on the other hand the stock has little volume … or the trigger price of $25 is hit the last second of the last minute of trading for the day … then your order will not execute before the market opens the next day at whatever the market value is at that time. This could put you dollars away from the $25.

However, the bottom line is that you get out of the stock that is or was going down in value.

Another risk is that if you set the stop loss too tight (For example at $29.00 on a $30.00 stock) you could get bounced out of the stock too soon just to see it go back up to $35 in the next day or two … and if you want to buy it back … you will pay more than what you got for it. This is selling low and buying high which is not a very good way to invest.

Mentioning buying the stock back; should you buy it back within 30-days of selling it you could get involved in what is known as “wash-sale rules.” What this means is that if you do take a loss on the stock at anytime, you would not be able to tax-deduct that loss – though, thanks to Uncle Sam, you will always be taxed on any gains you may have even if you buy it back in 30-days and sell it later at a gain.

Another risk … The stop could cause a loss on a trade that would have been profitable—or more profitable—had a sudden stop not kicked in. This situation can be particularly galling if prices plunge as they do during a market flash crash (plummeting, but subsequently recovering). No matter how quick the price rebound, once the stop-loss is triggered, there is no stopping it.

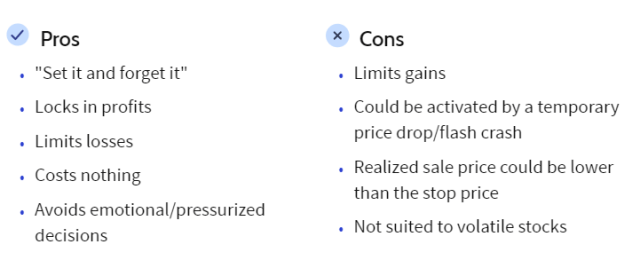

Here are a few pro’s and con’s of the Stop Loss Order:

Exit Strategy #2 – Stop Limit Order

A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. It is related to other order types, including limit orders (an order to either buy or sell a specified number of shares at a given price, or better) and stop-on-quote orders (an order to either buy or sell a security after its price has surpassed a specified point).

This type of order is an available option with nearly every online broker. Do not confuse an online broker with a retail broker (one you must call to execute an order).

The stop-limit order will be executed at a specified price, or better, after a given stop price has been reached. Once the stop price is reached, the stop-limit order becomes a limit order (not a market order) to sell, in this instance, at the limit price or better.

Notice the second bullet point above … but it’s not guaranteed to be executed.

A stop order is an order that becomes executable once a set price has been reached and is then filled at the current market price. A traditional stop order will be filled in its entirety, regardless of any changes in the current market price as the trades are completed.

A limit order is one that is set at a certain price. It is only executable at times the trade can be performed at the limit price or at a price that is considered more favorable than the limit price. If trading activity causes the price to become unfavorable in regards to the limit price, the activity related to the order will be ceased.

By combining the two orders, the investor has much greater precision in executing the trade.

A stop order is filled at the market price after the stop price has been hit, regardless of whether the price changes to an unfavorable position. This can lead to trades being completed at less than desirable prices should the market adjust quickly. By combining it with the features of a limit order, trading is halted once the pricing becomes unfavorable, based on the investor’s limit. Thus, in a stop-limit order, after the stop price is triggered, the limit order takes effect to ensure that the order is not completed unless the price is at or better than the limit price the investor has specified.

An Example:

Using the above example of buying stock at $20 – let’s assume it has increased to $40 per share for a nice 100% gain. You think the stock is going to continue to climb so you want to hold it … but at the same time don’t want to give up more than 50% of your gain should it decline. Here you may set a stop limit order for say $32.00 with a limit of say $30.00. This means that if the stock falls to $32 the stop order is triggered … but if the broker cannot get you a price of at least $30 or better the order becomes null and void and you keep the stock.

Risk of Stop Limit Orders:

While these do provide the seller of the stock a little more control in stating the minimum price they are willing to accept … it also means that they have a less chance in the order executing at all since execution is contingent on a particular price being met. In the case above … if the price drops to say $32 and then goes to $29 … it will not be sold since $29 is not $30 or better and you may have to go ahead and enter a market order to get out of the stock if it continues to fall.

It should be noted that Stop-Limit orders can also be used on the buy side.

For example, assume the stock you bought at $20 is trading at $30 and you want to buy the stock once it begins to show some serious upward momentum. You may put in a stop-limit order to buy with the stop price at $35 and the limit price at $37. If the price of the stock moves above the $35 stop price, the order is activated and turns into a limit order. As long as the order can be filled under $37, which is the limit price, the trade will be filled. If the stock gaps above $37, the order will not be filled.

Buy stop-limit orders are placed above the market price at the time of the order, while Sell stop-limit orders are placed below the market price.

Bottom line to these kinds of Stop and Stop-Limit Orders:

Stop prices do not guarantee execution (trade) prices. Once a stop price (trigger) is reached, trades are executed at the current market price. Therefore, the price at which a stop order is ultimately executed may be very different from the “stop” price, especially during volatile market conditions.

Stop orders may be triggered by a short-lived, dramatic price change. Be aware that during volatile market conditions, the price of stock may fluctuate significantly within a very short period of time. This volatility could trigger the execution of a stop order while the stock may return to prior price levels within a short time.

Sell stop orders may add to price declines during times of extreme volatility. If a stop order is triggered during a sudden and steep market decline, a sell order is more likely to result in a trade well below the stop price.

Placing stop-limit orders may help manage risks. By using a stop limit order, you are setting a minimum price you are willing to accept, but should understand that trades cannot be executed for a price that is worse than the stop price limit; therefore trades may not be executed at all. You may want to consider using stop price limits where the desire is to achieve a targeted price more than an immediate trade execution.

Only once you understand these kinds of orders should you consider using them.

Let’s use an example (a picture is worth a thousand words) to see how a simple Stop Loss Order could work.

Here we invest at $20 per share and the stock price begins to grow. When the stock price hits $30 per share and we have a $10 unrealized gain we decide to set a 15% stop loss. To get the price for the 15% you multiply the price of $30 by .85 and come up with $25.50. You put that in as your stop price. Let’s assume the stock soars to $50 before it starts to decline. In period 8 (this could be 8 weeks, months or years) the stock hits a price of $25.50 and is sold. Again, you may get more or less than $25.50 since the $25.50 is simply a trigger price and the stock will sell at a market price.

In this scenario, let’s assume you bought the stock back when it began its uptrend and hit a price of $30 per share in period 12. Then when it hits $40 per share in period 14 you again set a 15% stop loss ($34 per share) and let it ride.

Keep in mind you can choose a dollar value rather than a percentage value to set your stop loss – and the tighter you set it to the price – the more apt you are to be stopped out of the stock. If a “flash crash” occurs (a sudden drop and rebound in price) you may not want to lose it. Be careful on what you choose as a stop price.

Another thing to keep in mind is the fact that you can cancel a stop loss and reset it at any time. For example, in period 5 when the stock hit $40 per share you could have reset your stop loss at $34 per share and get bounced out earlier and at a greater profit. Also in period 15 when the stock hit $45 per share you could have readjusted your stop price to $38.25 per share and made a little more money if it hit that price – which it did not in this illustration.

REMEMBER: Stop Loss Orders do not guarantee a gain (though they can provide a gain) … but they do guarantee that you will not lose all your money if they hit.

Now let’s take a visual look now at the Stop-Limit Order.

In this example again we start with a stock at a price of $20 per share. In period 4 we set a 15% stop loss (or a price loss at $30 per share when the stock is $35 per share). However, we also set a limit price of $27 per share. What this is telling the broker is that at $30 per share your trigger price is set … yet you will accept no less than $27 per share for the stock. The limit order is “this price or better.”

WARNING: If you attempt to set the limit order above the stop order (let’s assume you set the limit order at $32) you are telling the broker to sell the stock at $32 or better. Well guess what … $40 is better than $32 and your stock will be sold when you place the limit order. You don’t want that.

Also remember … the limit order set below the stop order does not guarantee that the stock will be sold. It could drop from $30 per share to say $26.50 per share – right through the $27 limit order … so since the broker cannot get you $27 per share for the stock the order becomes null and void.

Again, if you use this order … you can buy the stock back and ride it higher and enter another Stop-Limit Order as shown. In this case it was entered in period 14 at a Stop of $34 and a Limit at $30.

Exit Strategy #3 – Trailing Stop Loss Order

This is my favorite Stop Order … the Trailing Stop Order. This is beneficial because the stop price automatically follows the stock price up but as the stock price drops the stop price levels off and never goes down. If the stock price hits the stop price your sell order is executed at the next market price … but if it doesn’t as the stock price starts to increase again … so does your stop price.

These orders can be set as a percentage of the stock price or as a point value. Here is how this order would look as an example:

As you will notice here we purchase the stock at $20 per share and immediately set a 15% stop loss order ($17.00 per share). As the stock increased to $30 per share our stop loss automatically was driven up to $25.50 per share – $5.50 more than we paid. Once the stock hits $45 per share our stop price is at $38.25.

Then, as the stock price begins to decline our stop price holds level at $38.25. If the stock price drops below $38.35 as it did just before period 7 … our stop price is hit and the stock sells.

Assuming we bought it back at $20 per share and did the stop loss all over again … in this case the stock goes to $50 per share and the stop price trends up to $42.50 per share. I don’t think anyone would be mad if their stock is sold at a price of $42.50 assuming they bought it for $20. That’s a gain of about 112.5% if it sold at exactly $42.50 (which it will sometimes, but not guaranteed at any time). At least I know over my years in the business I did not have too many mad clients once they new that the stock was sold at a profit in a down market.

The bottom line here … is that this kind of stop order will allow you to set an order that will follow the stop loss up with the assurance that once your stop price is raised it will not be lowered unless you manually lower it.

Prior to my company allowing Trailing Stop Losses I would have to go into each clients account and do this manually about two times each month. You talk about time consuming and a hassle. Then, I had to hear clients complain about the fees I was charging for keeping up with all this! They never complained though when the market trended down and I was able to close out their positions (rather the computer was able to close out their positions) at a gain in most instances or a very small loss in others.

Two time periods on Stop Loss Orders

When setting Stop Losses, Stop-Limit Losses and Trailing Stop Losses … there are two time periods you should concern yourself with. Check out this screen from my brokerage account:

Notice the white circle … There are two times … Day or GTC. Most brokerage firms default to “DAY” and you probably do not want this.

A day order means that the order is only good for the day it is set. This means that if you want the order tomorrow, next week and next month … you will have to come in each day and set it. This is good for “Day Trading” since you would likely sell out at the end of the day if the order price was hit or not.

In most cases you will want to choose GTC which stands for Good Til Cancelled. You, the investor – if you are making your own trades – or your broker (if he/she makes your trades) are the only ones that cancel this when ready. That being said, however, most brokerage firms do have a limit on these GTC orders. Many of them will self-cancel after a period of time (such as 3 months, 6 months or possibly even a year). You need to check with the brokerage firm you use to see how long these GTC orders will last.

The brokerage firm I use has a time limit of 6 months. This means if my stock did not sell under the Stop Order … I will need to go back in a reset it. If using Stop or Stop-Limit orders it is good to check them from time to time anyhow (I’d recommend at least every couple of weeks in a strong bull market). But if using a Trailing Stop Order you can rest assured your order updates automatically based on the price of the stock each and every minute of the day for the entire period the order is good for.

Exit Strategy #4 – Insuring Profits

Now all three of the strategies mentioned above are “free” to use. There is no cost, other than time, in setting them up. This 4th Strategy, however, will cost you some money … but could be well worth the additional cost.

How do we insure profits? To some this may seem complex … but it is really quite simple. No, to my knowledge, there is not an insurance company out there that will insure your profits. However, you can become your own insurance company with a little knowledge and know-how.

All I am talking about here is buying a “Put Option” that will allow you to sell your stock to the seller of the Put Option if it hits a certain price by a particular date. You, of course, are not OBLIGATED to sell – but the seller of the Put Option is OBLIGATED to buy the stock if you exercise your RIGHT TO SELL.

ONE word of CAUTION: If you hold the option until the expiration date and it is in the money (e.g. the stock is at a lower price than the strike price on the option) you could be assigned to sell it by the Options Clearing Corporation (OCC). This is why it is never a good idea to hold an option to expiration.

Most investors buy a Put Option on a stock or index because they think that stock or index is going to go down. When this happens the value of the Put Option goes up and they can sell it for a profit. Investing this way requires risk.

However, if you are buying a Put Option to protect profits in a stock you now hold … this is not risky. As a matter-of-fact … you are mitigating risk. Here is how this could work.

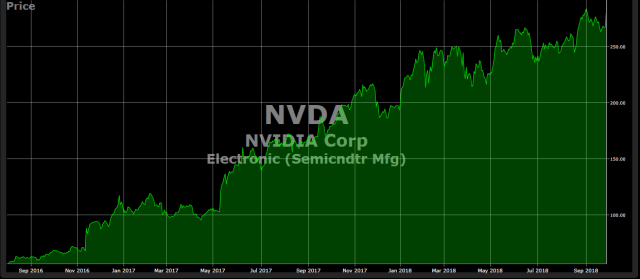

Let’s assume that you bought 100 shares of Nvidia (NVDA) on September 1, 2016 and paid the closing price on that day of $63.15 per share. Your investment (not including commissions) would be $6,315.00. Let’s further assume that on September 4, 2018 (just two years later) this stock was selling for $283.70 per share (closing price on that day). Your value is now $28,370 which is $22,055 more than you paid for it.

You begin to worry that due to trade problems with China and other parts of the world the Semiconductor industry could take a hit and your concerned that your stock could as well. You really don’t want to sell the stock and pay taxes on the gain … but at the same time you don’t want to take a big hit in value should the stock start to trend down.

You look at the potential of loss and decide that if the stock were to hit $225.00 you will sell it. The only problem is that your headed for a long trip and are not sure you will be near a computer on the day that it hits that price.

What can you do?

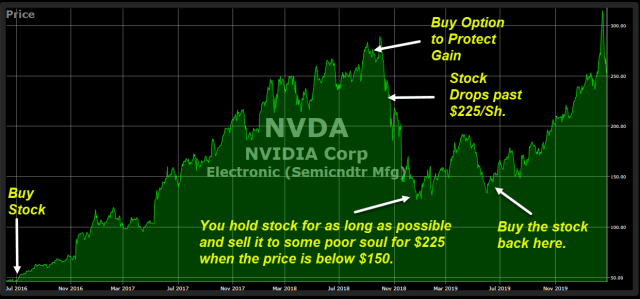

You decide to purchase a Put Option with a strike price of $225 that will run for a period of say 6 months.

If you were doing this today you would likely buy the following Put Option:

You would pay a “premium” for this option in the amount of $21.35 per share … so one contract (100 shares) would cost you $2,135.00. However, that money would be protecting gains as follows ($22,500 – $6,315 = $16,185). Bottom line it would cost you $1.00 to protect $10.54 in stock value for a period of 204 days from now.

Had this actually happened … look at the next chart of NVDA as compared to the last one (don’t let the dates in the graphic confuse you, I had to go back in time).

You, of course, would not want to do this on every little stock you own … but for those large companies that you may want to keep through the ups and downs … this alternative will provide you choice.

You don’t have to sell the stock … but you have the right too. If it is a big dividend payer like AT&T, or Johnson & Johnson … you may want to hold the stock for the dividend but want the right to sell it if things really get bad.

Bottom Line: This is insurance and regardless of what people are saying these days about “free insurance” — there is no such thing.

The point of this article:

When we have had markets like we have had over the past 11 or 12 days … there comes a time to “stop the bleeding” unless you are a very long-term investor.

I hope this article as pointed out some EXIT STRATEGIES you can employee to keep your profits in the stock market just a little bit safer. I have a friend who believes the stock market is just one big Ponzi Scheme between Wall Street and the average investor- and it’s all because (I believe) he never learned to protect his profits.

Take care and make some Investment Waves …

Jerry Nix | Freewavemaker, LLC